It seems that no matter where you drive in Tasmania, you’re greeted with breathtaking landscapes and towns steeped in charm and history.

From its capital, Hobart, you can indulge all the senses at the ground-breaking MONA, and sample arts and crafts at the renowned Salamanca Market. Then, travel down to historic Port Arthur, or through the state’s centre to Cradle Mountain and up to the world’s longest single-span chairlift at Cataract Gorge. Here, you can also try some of the best seafood and local produce on offer.

With all these amazing attractions, it’s no surprise that more Tasmanians are looking to drive. In fact, Tasmania had the largest percentage increase of newly registered vehicles in Australia, with a 2.6% increase in 2018 to 2019.1

All these new vehicles – along with the existing ones – need some form of car insurance, so here’s our breakdown of car insurance in Tasmania.

Comprehensive car insurance is the highest level of car coverage available. A standard policy covers fire and theft, along with repair costs for both your car and any other vehicle or property that you damage. It can even cover damage caused by things like storms and hail! Optional extras such as personal effects cover, replacement keys, roadside assistance and more can also be added to a Comprehensive policy.

Third Party Property insurance covers other vehicles and property damaged by your car, from an accident that was deemed your fault. It doesn’t cover damages to your car. For that type of coverage, you would need Comprehensive car insurance.

Similar to Third Party Property, Third Party Fire & Theft insurance covers other cars against damages caused by your car. While it still won’t cover your car in the case of an accident, it will cover repair or replacement costs if your vehicle is stolen or destroyed by fire.

CTP car insurance is mandatory for all motorists in Tasmania. If someone is injured or killed as a result of your driving, CTP covers any liability you may be subject to. It’s usually bundled in with your registration fees through the Motor Accidents Insurance Board (MAIB).

With the exception of CTP, car insurance is completely optional. However, given the limitations of CTP, it’s worth purchasing extra coverage for your car.

The additional insurance you should buy will depend on how you value your car and what incidents you want covered. Here’s a quick comparison of what each type of insurance covers.

| Insurance type | Damage to your car | Damage to another person’s car or property | Damage or loss caused by theft or fire | Injuries or death to other people in an accident |

| CTP | No | No | No | Yes |

| Third Party Property | No | Yes | No | No |

| Third Party Fire & Theft | No | Yes | Yes | No |

| Comprehensive | Yes | Yes | Yes | No |

Note: There are more factors and variables that may affect your level of coverage. Always refer to your Product Disclosure Statement (PDS), which includes important information specific to your policy.

Comprehensive car insurance will cover many different scenarios – including damage from hail, storms, fire and theft – but you may also have a choice of optional extras that can prove to be valuable.

The price of car insurance depends on a lot of factors, including:

Because of this, the price of car insurance varies widely across providers, policies and people. If you want an idea of how much car insurance may cost you, you can complete a quote through our free car insurance comparison service.

Your car insurance needs are different from the next customer, which is why we have various providers and policies for you to choose from.

Using just some details about you and your car, you can find a great deal in just minutes from various reputable car insurance providers.

We helped more than a million Australians complete quotes for car insurance in 2018 and we want to help you do the same.

Our car insurance comparison service is free to use. No hidden fees, just the power of comparison. Search until you find the product you’re after.

Where you live can impact your policy. The amount of crime in your neighbourhood, where you park your car and the overall safety of the roads can impact how likely you are to make a claim. This in turn can influence your premium.

Tasmania is a wonderful state to live in, but it still pays to be vigilant when taking care of your car.

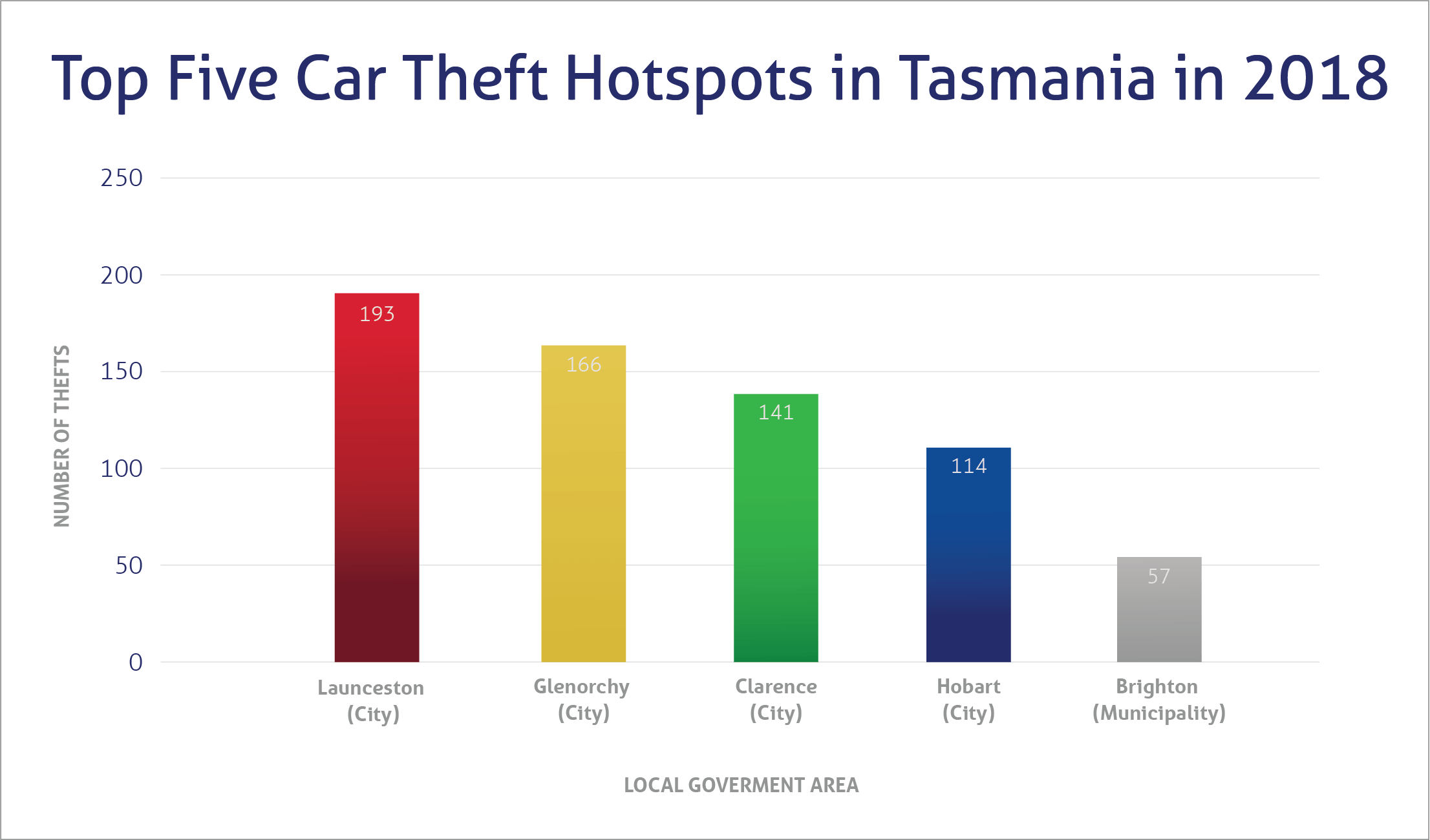

In 2018, there were 1,006 car thefts reported.² However, out of these incidents, there were 898 short term thefts (where the vehicle was recovered).³

When you’re at home, it’s always a good practice to make sure your car is secure – particularly since 52% of car thefts in 2018 occurred in residential areas.²

While these statistics seem confronting, it’s worth noting that the number of vehicles stolen in 2018 is around 0.2% of the total number of vehicles in the whole state.

Although roads may not be as congested in Tasmania as they are in the more populated states, precautions still need to be taken when you’re driving.

In 2018, there were 33 reported road fatalities in Tasmania.⁴ Out of these 33 fatalities, 14 were drivers and five were passengers.

Overall, there were approximately six road deaths in Tasmania for every 100,000 people, which is the fourth highest in Australia behind the NT, WA and SA.⁵

Do you still have one or two questions? Relax! We’re here to answer them.

There are numerous factors car insurance providers take into account when calculating your premium. Here are just a few things that might affect the price of your policy:

Excess is the amount you agree to pay for making a claim. So, if you elect an excess of $600, this is the amount you would have to pay when you make an insurance claim. However, with car insurance, you generally only have to pay an excess when you’re found to be at fault or if your claim doesn’t involve a third party.

Excess amounts vary depending on the policy and some providers even offer lower premiums if you agree to pay a higher excess. Conversely, paying a lower excess can lead to paying higher premiums.

Potentially, yes. Your postcode affects your insurance premiums, because your new neighbourhood may have a higher or lower incidence of drivers making insurance claims. For example, say you’re moving from Burnie to Glenorchy. Glenorchy has a higher incidence of car thefts, which may lead to a higher premium.

Where you park your car overnight at home also affects your premium. For example, if you previously parked in a garage but you’re now parking on the street, your premiums may also rise.

Finally, the rate of traffic accidents both in your new neighbourhood and on your route to work can affect your insurance premium. It’s wise to give your insurer a call when you plan on moving, so you can budget for the new price.

1. ABS – 9309.0 – Motor Vehicle Census, Australia, 31 Jan 2019. Published July 2019. Accessed October 2019.

2. ABS – 4510.0 – Recorded Crime – Victims, Australia, 2018. Published June 2019. Accessed October 2019.

3. NMVTRC – Dashboard. Accessed October 2019.

4. Department of State Growth: Transport – Tasmanian Crash Statistics: Fatalities 2018. Accessed October 2019.

5. BITRE – Road Deaths Australia: September 2019. Accessed October 2019.

Don’t stall now. See if you can track down better car insurance cover

Compare car insurance